Canadiens eliminated from playoffs in loss to Lightning

Steven Stamkos and Nicholas Paul had two goals apiece to lift the Tampa Bay Lightning to a 7-4 win over the Montreal Canadiens on Thursday.

The highest profile — and by far most valuable — sports property in Canada was born out of the need for change, and often turmoil.

The owners of the Toronto Maple Leafs and Toronto Raptors were initially rivals, the old guard vs. the new. And each organization had its own internal struggles, battles for control. But the Leafs and Raptors finally came together corporately in February 1998 — forming what has since been known as Maple Leaf Sports and Entertainment, or MLSE — and a year later moved together into what was then the Air Canada Centre.

It hasn’t been wholly happily ever after ever since but, for the most part, the ensuing 25 years at MLSE have been marked mostly by calm, impressive stretches of competitiveness from its teams and — as always — hefty profits.

But nothing lasts forever.

“All partnerships eventually fail,” says Richard Peddie, who was MLSE’s first president.

Put another way: “The governance is broken,” says one sports industry insider.

Change is in the air at MLSE, which counts the Maple Leafs, Raptors, Toronto FC in MLS, the Marlies in the AHL, the Argonauts in the CFL, Scotiabank Arena and BMO Field among its holdings and is valued at about $8 billion (US) — dwarfing any other sports property in Canada and ranking among the top 10 globally, according to Forbes.

The most tangible example for the moment is the introduction of Keith Pelley as chief executive officer. He formally took charge on Tuesday, giving the company the kind of high-profile, dynamic leader missing since Tim Leiweke left MLSE in 2015.

Pelley will be taking the helm of a company almost certainly headed for transition at the ownership level and with teams having either floundered or treaded water of late. The business is owned by telecom rivals Rogers Communications Inc., (which also owns Sportsnet) and BCE (the parent company of Bell), which equally share a 75 per cent stake, and Larry Tanenbaum via his holding company Kilmer Sports Inc., which owns a 20 per cent stake in the organization after selling a five per cent indirect share to OMERS, a Canadian pension fund, in the summer of 2023.

Under the ownership agreement, the two telecom partners have the right to buy out Tanenbaum by July 2026, according to sources, and are expected to do exactly that.

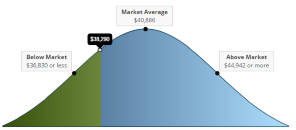

Bell and Rogers initially challenged Tanenbaum over the sale of a portion of his stake to OMERS for $400 million. The deal pushed MLSE’s valuation to $8 billion, meaning Tanenbaum would be owed more money when he exits.

As it stands now, Tanenbaum could pocket an additional $1.6 billion for his remaining 20 per cent stake of MLSE, which will likely go a long way toward funding his recently announced Kilmer Sports Ventures, an investment fund which — in theory — gives Tanenbaum a vehicle to compete in the same space that MLSE has long operated without any local competition.

“I think it’s 100 per cent [Bell and Rogers] will buy out Larry,” one source said of the likelihood of Tanenbaum leaving by 2026. Should it come to pass, it will end Tanenbaum’s run as the single constant at MLSE since it was founded and the lone island of individual ownership in what has always been an ocean of corporate money, from banks to pension funds to telecom giants. It will also see two of Canada’s biggest business rivals have a 50-50 share in one of its most public-facing brands with no third party to act as a buffer or tie breaker or public face.

That’s the role that Tanenbaum has played even though he’s always been a minority shareholder. He’s been the chairman of the MLSE board for the entire history of the company and has represented the Raptors at the NBA’s board of governors and the Leafs with the NHL. He’s acted as a respected backroom operator at the league levels and a close ally and source of support for those who run the franchises that the fans follow locally.

Team dinners and celebrations over the years have often been held at Tanenbaum’s Forest Hill estate. When there is a key player contract to be signed or free agent to be wooed, Tanenbaum has always represented MLSE ownership. Over the years, when key figures leave the teams, they typically recognize “Mr. Tanenbaum” in their farewell, not Rogers chairman Edward Rogers or Bell president Mirko Bibic.

What Tanenbaum’s absence would mean to the teams that drive MLSE’s value will be the unknown that Pelley and the reconfigured ownership group will have to answer in the coming years.

Pelley will have his hands full, predicts one source.

“Keith is a great choice [as MLSE president]. He’s likeable, experienced, dynamic — he’ll do a great job, but the best coach in the world can’t fix a divided locker room.”

Pelley has already made his presence felt. On March 9, three weeks before his official start date, he attended Toronto FC’s home opener, a 1-0 victory over Charlotte FC. Since it was an afternoon match, he flew to Montreal to watch the Maple Leafs beat the rival Canadiens 3-2 that same night. Pelley joined the team on the charter flight home and, according to several sources, went for dinner with team president Brendan Shanahan in the ensuing days.

On Monday — the day before his official start date — Pelley attended Raptors practice at the OVO Athletic Centre, conferring with Raptors president and vice-chairman Masai Ujiri and general manager Bobby Webster as they watched injured franchise star Scottie Barnes go through a workout as they play out the string in what has turned into a rebuilding season that will end with the Raptors’ third spin through the NBA Draft lottery in the past four years.

One of the pressing questions will be how a change in ownership would affect Ujiri, who, before the Raptors’ recent struggles, had led them to nearly a decade of unprecedented success — culminating in the 2019 NBA championship — since arriving in 2013. Through it all, Ujiri could rely on nearly unequivocal support from Tanenbaum.

Tanenbaum’s future with the organization was an issue that — per sources — was a concern during Ujiri’s drawn-out contract negotiation with MLSE that culminated with Ujiri signing a five-year contract in the summer of 2021 that makes him one of the highest-paid executives in North American sport. At the time, Ujiri pledged that he was going to be with the Raptors for the foreseeable future. The term of his deal? “Forever, man. Forever … I’m home, man. This is it.”

But that commitment will get road tested sooner than later given that Ujiri’s contract runs through June 30, 2026, aligning him almost exactly with Tanenbaum’s possible departure.

Similarly, Shanahan’s standing will likely get a level of scrutiny that he may have been buffered from with Tanenbaum on board. The Hall of Fame forward turned executive has one year left on a six-year contract worth in the range of $25 million to $30 million, per sources, making him one of the highest-paid front office figures in hockey. And while the Leafs have been considered championship contenders for most of that run, the core of Auston Matthews, Mitch Marner, William Nylander, John Tavares and Morgan Rielly has just a single playoff series win to show for it. Another first-round exit could very well put Shanahan on the clock.

At the very least, the expectation is that the reporting structures at MLSE will be more formalized, with the presidents of the franchises reporting to Pelley as CEO. That was the arrangement when Leiweke was on the job and Peddie before him. In the interim, Shanahan and Ujiri had the option to report directly to the board, not that they always exercised it. Specifically in Ujiri’s case, he has always trusted Tanenbaum and prefers to deal solely with him when the need arises.

Shanahan — who signed a six-year contract extension in May 2019 — hired Lou Lamoriello as Maple Leafs general manager in 2015. During his three-year stay, Lamoriello strongly believed in respecting the chain of command. It wasn’t so much asking for permission, but keeping his superiors informed: “This is what I’m thinking,” or, “This is what we’re about to do.” Shanahan learned from that. While MLSE’s previous president and CEO, Michael Friisdahl, had a hands-off relationship with the sports teams, Shanahan offered the same courtesy. The arrangement continued under Cynthia Devine, the well-respected CFO who replaced Friisdahl on an interim basis. While Shanahan had the power to deal directly with the board, he would inform the CEO, as well.

As one source said, “Sometimes a board wants to hear from its CEO, alone.”

Things won’t be as nuanced under Pelley, a massive personality. He rewards performance and encourages creativity, but there is never any question he’s the boss. According to multiple sources, having the franchise leaders report to him was a condition of Pelley’s before taking the MLSE job.

What the ownership group Pelley works for will look like in the years to come is another question.

If Tanenbaum is indeed on his way out, it will be the end of an era at MLSE, but a predictable byproduct of a never-perfect partnership. In recent years, issues between Tanenbaum and his partners have bubbled into public sphere. Among them:

There was the aforementioned legal challenge that followed Tanenbaum’s share sale to OMERS. According to sources, the issue has been quietly put to bed, but that it happened at all suggests an ownership group that isn’t seeing eye-to-eye on everything, and on some of the bigger issues — how much the company is worth — especially.

There was the disagreement between Tanenbaum and his partners regarding the pursuit of a WNBA franchise: In early 2023, MLSE management made a presentation to the board about the possibility of pursuing a WNBA team for Toronto, and Rogers chose to stay the course, given various logistical and financial hurdles. Tanenbaum and the Raptors’ side of the organization — with support from Bell — wanted to push forward, while acknowledging that the path to getting a return on what could have been a $100-million upfront investment could take time and came with no guarantees.

But coming out of the pandemic, Rogers wanted to focus on MLSE’s core business, and the board requires consensus on all major decisions. At the time, Tanenbaum asked if he could purse a franchise bid on his own via Kilmer Sports, and there were no objections. Just last month, former Raptors vice-president Teresa Resch — one of Ujiri’s most trusted lieutenants — left the club to join Tanenbaum’s newly launched Kilmer Sports Ventures, charged with, according to sources, mounting a WNBA bid among other ventures.

According to a report in the Toronto Star, Edward Rogers was the holdout during the negotiation for Ujiri’s current deal in the summer of 2021, refusing to sign off on a five-year contract that pays Ujiri $15 million annually and includes incentives tied to the Raptors franchise value among other benefits. Eventually, Tanenbaum had to use his status as MLSE chairman to break the stalemate. In the fallout, there was considerable tension between Ujiri and Rogers, although according to multiple sources, much of that has blown over and the relationship is now amicable. “The only issue was price. It wasn’t [personal]. It was, ‘Is [Ujiri] really the most valuable sports executive in the world?’” While Shanahan’s negotiation never got as public or seemingly intense, there were similarly some challenging moments, per sources, but they were characterized as “fair” in the end.

How it all gets navigated and resolved will likely go a long way in shaping the competitive trajectories of MLSE’s teams in the decades to come. Much of the heavy lifting will fall to Pelley.

In the immediate term, the assumption is that Bell and Rogers will become equal partners in a business that has — conservatively — quadrupled in value since the two telecom rivals teamed up to buy the majority share of MLSE from the Ontario Teachers’ Pension Plan in 2012 when the business was valued at $1.9 billion.

Beyond that, Rogers has additional sports holdings as sole owner of the Toronto Blue Jays, and Edward Rogers has shown signs of wanting to be a bigger player in the sports landscape. As an example, he was part of a 2022 bid to buy Chelsea FC of the English Premier League that was headed by Washington Commanders owner Josh Harris and his partner David Blitzer, who owns the Philadelphia 76ers and New Jersey Devils, among other properties. The Blue Jays are in the final stages of a $300-million renovation of Rogers Centre, having already spearheaded a $102-million renovation of their training facilities in Dunedin, Fla.

Given that Edward Rogers’ holdings with MLSE and the Blue Jays are valued at upwards of $5 billion, he’s a figure who would be taken seriously in any context. There are others close to the situation who believe that Rogers are positioning themselves long-term to be buyers in the sports landscape, locally and beyond.

Conversely, the appetite Bell — which also owns a minority share of the Montreal Canadiens — has to stay in the game is an open question. Given MLSE is a money maker and has historically been an appreciating asset, it’s not one that needs to be answered under any pressure, but it’s worth considering.

In the meantime, no one is expecting Tanenbaum to remain passive as all of this unfolds.

When his exit strategy was originally planned back in 2011, it was timed to roughly correspond with Tanenbaum’s 80th birthday, which is in 2025. It turns out that even with 80 approaching, Tanenbaum has no interest in slowing down. In addition to reportedly hiring Resch and eying the WNBA, he hired highly respected international soccer executive Ivan Gazidis to run Kilmer Sports Ventures, which would suggest ambitions beyond women’s basketball in North America.

Seeing that Tanenbaum has already began selling down his shares, it would seem unlikely that he could find a way to reverse the field and become the controlling shareholder of MLSE, but underestimating him has never been a good idea.

“A lot of people think it’s done, Larry’s gone [from MLSE], but I’m not sure that’s the case,” said one sports industry figure familiar with the situation. “I don’t see Larry going quietly. People seem to think the story is written, and I just don’t. Larry is smart, Larry’s connected, Larry has money, and he knows how to raise money. We’ll see how it all plays out. Yeah, there’s the contract and there’s the agreement, and then there’s what will actually happen in reality. Are they all the exact same thing in this one? We’ll see.”

As the familiar face with the new job title, it will be up to Pelley to navigate whatever changes are coming and dealing with the fallout.

No one is doubting Pelley’s credentials: The 60-year-old Toronto native has in his career been president of TSN, which is owned by Bell Media, and later president and chief executive officer of Rogers Media. He was previously president of the Argonauts, which is an MLSE property, and worked for Bell and Rogers as head of the Olympic Broadcast Consortium in the build-up to the 2010 Winter Games in Vancouver. Most recently, he has been based in England as chief executive of golf’s DP World Tour (previously the European Tour).

When his MLSE hiring was announced, Pelley made it sound like he was stepping into a dream job: “This was the one opportunity I simply could not resist because of what this city and its teams mean to me,” he said. “I look forward to joining MLSE in April and bringing the values to the organization — culture, teamwork and community — that have been so important to me over the course of my career.”

A dream job it may be, but taking over a company seemingly headed for significant ownership changes while trying to please fan bases hungry for success might make for interesting times and sleepless nights.

Recommended Story For You :

FINALLY DUNK LIKE A TOTAL BADASS...

7 quick and easy things to INSTANTLY IMPROVE YOUR BALL STRIKING.

AVOID A SCAM BY ORDERING A HIN LOOKUP

Get Vehicle History You Can Trust

The ONLY Swing Designed Specifically For Senior Golfers

An URGENT Message For Golfers Who Want More Distance

Premium Quality Laser Rangefinder

You'll NEVER get to the top of your game on your own

Why The OTI Method Is So Effective